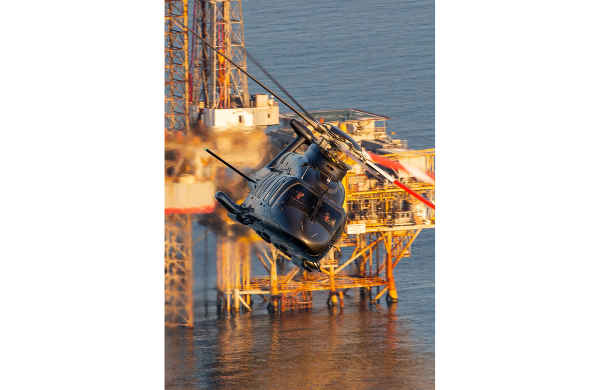

Collective belief argues that the H225’s time, as far as offshore operations are concerned, is done. Not so, says Airbus. Photo: Airbus

For many, the loss of the CHC Super Puma in Norway signalled the end of H225 operations as far as the oil and gas industry is concerned. The advent of the S-92 saw to it that several offshore operators had already turned away from the Puma family, that fateful day sealing the deal.

While things have been quiet in offshore support, H225s have remained popular in aerial work and firefighting applications. Photo: Airbus

And yet, and yet, rumours of the demise of the Puma family are premature. Indeed, Airbus Helicopters’ predictions for the H215/225 family remain bullish. Speaking at the company’s pre-Heli-Expo briefing, Super Puma Programme Head Michel Macia dealt with the elephant in the room early, noting yes, there had been a drop in Oil & Gas operator demand from 2017, but the type retained its following in the aerial work, firefighting and military sectors and yes, the non-North Sea offshore market too. That interest has meant that production has averaged around 20 aircraft a year over the last six years, a volume that he expects to continue for the coming five years, critically without any step up in offshore support demand.

What, then, is the future of the H225 as an offshore support platform? Let’s take it as read that for operators, the future, by and large, looks super-medium shaped. If you look at the order books and pipelines for both the H175 and AW189 (presumably the B525, too, when it crosses the certification finish line), reflect that.

It appears beyond question that they will dominate; even so, the reality remains that while super-mediums are the apparent solution for around 80% of offshore support missions, there is still that pesky but significant 20% of sorties where the payload/range of the super-mediums will not cut the mustard. For those missions, heavies are rather like a dinner jacket, redundant most of the time, but when you need one, nothing else will do.

It all boils down to Sikorsky’s plans for the S-92. In a post-S-92 world, there is nothing for the H225 to compete with. Photo: Bristow

Surely there are still enough S-92s available to take up the slack, at least for the medium term? It seems that quite aside from the well-publicised issues with support and the increasing percentage of the fleet sidelined as a result, there lurks the spectre of airframe age. While the type has a projected life of 30 years, several offshore end customers place a 20-year limit on airframe age for contracts. For the S-92, the sands of time are running out, with the youngest aircraft in the offshore fleet hitting that milestone within the next 10 years.

Of course, Sikorsky could restart production. At Heli Expo last year, although Sikorsky’s Jeffery Jurgens predicted a demand for “12-15 S-92A+s a year,” he did not commit to production beyond the five airframes that were in various stages of completion at that time, none of which were destined for the offshore sector. Nor has the company said anything more about new aircraft production.

Even so, Sikorsky may announce a resumption of production next Tuesday in Anaheim; it’s possible but not probable. Let’s imagine they don’t. What then for that 20% of sorties for which only a heavy will do?

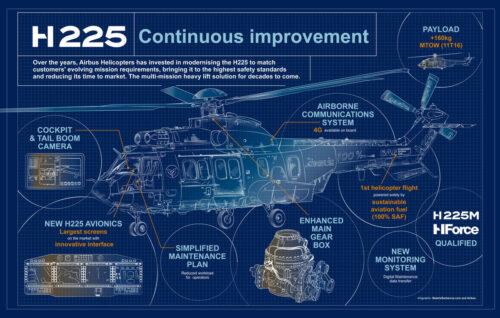

Not your Dad’s Puma: Airbus points to the continuous improvements that will keep the type in production beyond 2040. Image: Airbus

This, argued Macia, is where the H225 provides the solution, pointing to the new main gear box design and a host of other improvements to the design beyond those required by regulators. He added that the H225 will remain in production beyond 2040 and will be the company’s heavy platform for “decades to come”. So, while oil and gas operators may say that they don’t see a place for the big cat in their lineups, and reportedly, many have said precisely that, in a post-S-92 world, there may be no other option.

The cat could be back.