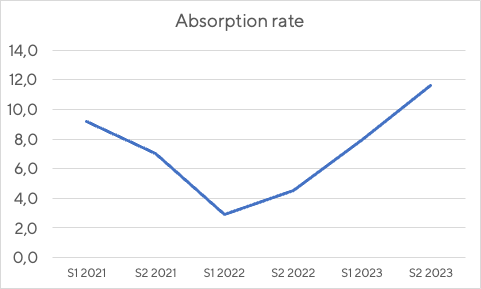

Over the past year, the absorption rate across the single-engine turbine market has increased from around seven months to just under a year. While for EMS-configured aircraft, the rate is still under six months, the corporate market rate is 13 months. Against a background where OEM new aircraft backlogs are as healthy as they were a year ago, this is baffling even for experts like Aero Asset’s VP of Market Research Valerie Pereira: “There are a number of factors that could be in play to explain this phenomenon. You had Ukraine as a factor a year ago, so you have to add what’s going on in the Middle East as well as the prospect of it being an election year in the United States, which always seems to have an impact on sales volumes. Although that’s more of a factor in North America – I think there’s a lot of uncertainty. In addition, a lot of buyers are looking for airframes no more than 10 years old. Aircraft with an age less than that typically move on a lot quicker, especially if it is enrolled in an OEM programme.”

Another element Pereira said is a factor in the singles market is that buyers, especially owner-operators, are a lot more educated about values than they were and are willing to pay a premium for an aircraft that more closely resembles their ideal in terms of age, history and location. They are also willing to wait for that ideal aircraft to come onto the market. “Buyers are more cautious; they are not going to invest in something with high time; they’d rather just wait.” It is this element that may also be impacting sales of younger, low-time aircraft. “If you are an operator that needs an aircraft right now to fulfil a contract, they might be more willing to move on things like time on the airframe, but for the owner market, they are just as likely to say “If I wait a year or 18 months I can have new so I’ll wait.”

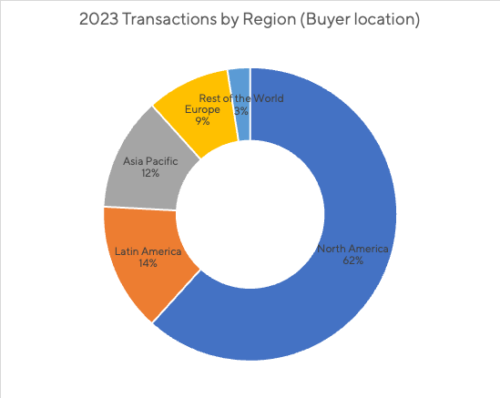

Pereira said this comes with some caveats, like that for a variety of financial and personal security reasons, many buyers within the region prefer to acquire aircraft already in the country and accordingly attract a premium and therefore, once an aircraft is brought into, say, the Brazilian registry, it will tend to stay there. “One thing I’ve learned from living in the region is that if an individual or company is wealthy, there are a lot of eyes on them, and those eyes are thinking about how they can get some of that wealth, and some of them will be criminals looking to extort through kidnapping so there is a natural reluctance to reveal information as part of an overseas purchase.” But the important thing to keep in mind, added Pereira, is that while eyes are often on the Asia-Pacific region for growth, that market seems to be subject to fluctuations in demand, whereas Latin America, and Brazil especially, keeps on steadily growing.

Another key indicator in the Aero Asset Market Report is the data concerning liquidity by type, which shows that Bell 407 variants top the basket of tracked singles. What is interesting is another apparent paradox, with average prices paid rising year on year in four out of the five types tracked while the supply and absorption also increased. However, that apparent paradox may also be a reflection that the lower time or otherwise more attractive offerings with their attendant premiums are moving on at the speed seen in 2022 while the ‘wallflowers’ languish on the re-sale market for rather longer.

Images: Aero Asset and Bellflight