In its pre-Heli-Expo briefings to the trade media, Airbus Helicopters has forecasted global demand for at least 16,200 helicopters worth EUR 120 billion over the next 20 years. It expects that 74% of that demand (or 11,968 aircraft) will be for fleet replacement, while the remainder will be for growth. Consequently, the world’s in-service helicopter fleet is expected to grow from 26,331 to 30,568, with 16,205 aircraft delivered between 2023 and 2042.

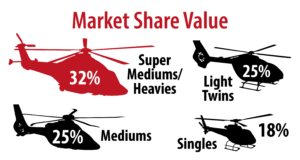

When it comes to value, the shares are almost reversed, with the Super Medium/Heavy sector expected to be responsible for 32% of sales value, Light and Medium Twins claiming a quarter of sales value each and Singles responsible for 18% of sales revenues.

Much of the report’s optimism centres on the recovery in flight hours as the world emerges from the effects of the pandemic and the associated economic slowdown. “It was interesting in earlier slowdowns, operators tended to park aircraft and fulfil the reduced demand by flying fewer helicopters for the same amount of hours per aircraft. In the pandemic, operators tended not to park but reduce the number of hours flown across their fleets. In the last year, all of that excess capacity has been absorbed,” explained David Prevor, Head of Marketing at Airbus Helicopters. “At the same time, market supply in the second-hand market is falling; many of those who formally had

been thinking of selling for upgrade are now keeping the asset to be sure of meeting demand.”

While discussions about fleet growth are always of interest, it would be churlish to forget that Airbus expects the bulk of new aircraft deliveries to be for fleet renewal, and Prevor saw some of the likely trends already emerging: “As far as offshore support is concerned, especially in the North Sea, the role traditionally performed by Heavies is now moving to Super Mediums. If you look at the S-92 fleet, the oldest ones are 20 years old, and the bulk of the fleet was delivered around 15 years ago, so in the next seven to 10 years, you will see operators looking to replace those aircraft, and they will be doing it with Super Mediums.” An assertion borne out by the fact that neither Airbus nor Sikorsky have made sales for Heavy class aircraft in the offshore support market for some time. Arguably if anything, the trend may be moving to downsize, with Airbus expecting great things once the H160 gains its long-awaited FAA certification and enters service with PHI. Of course, Prevor added caveats when discussing mature markets, noting that there is a tendency when forecasting to be “over conservative about prospects in mature markets which often tend to yield more than expected”.

Interestingly, while Airbus said the advent of eVTOLs will cause a change in the market, it does not expect it to be the seismic shift forecast by so many. “We see it as a complementary shift; eVTOLs will be as much about adding capacity but in a market that mostly does not exist yet,” explained Prevor. “In fact, we expect there to be a greater impact, initially, at least, on surface transport, than helicopter traffic. When we look at likely eVTOL capabilities and areas where they truly overlap with helicopters, we see an impact on only around 150 helicopters in the forecast period.”